how to pay meal tax in mass

Search the Commonwealths web properties to more easily find the services and. The move comes as Massachusetts restaurant scene is partially shut down until at least April 6.

38 Health Tips In 2020 Infographic Health Coconut Health Benefits Thyroid Health

Massachusetts general sales tax of 625 also applies to the purchase of wine.

. 9 am4 pm Monday through Friday. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is. If you plan on dining out during the states sales tax holiday later this month youll still have to pay the 625 percent Massachusetts meals tax.

Some jurisdictions in MA elected to assess a local tax on meals of 75 bringing the meals tax rate to 7. You can learn more by visiting the sales tax information website at wwwmassgov. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Use these guidelines to better understand Harvards tax obligation as a purchaser. In Massachusetts there is a 625 sales tax on meals. In Massachusetts wine vendors are responsible for paying a state excise tax of 055 per gallon plus Federal excise taxes for all wine sold.

Tax Department Call DOR Contact Tax Department at 617 887-6367. On a 100 restaurant check a customer would pay an extra 75 cents. You will need the Letter ID from the bill issued.

Massachusetts local sales tax on meals. 29 will be eligible for tax relief state officials say. This page describes the taxability of food and meals in Massachusetts including catering and grocery food.

The official search application of the Commonwealth of Massachusetts. In the More section select the Make a Bill Payment hyperlink. The local meals tax does not increase restaurant bills significantly.

Massachusetts Wine Tax - 055 gallon. Businesses that collected less than 150000 in regular sales and meals taxes in the year ending on Feb. Select the Make a Payment hyperlink.

Lets start with simple step-by-step instructions for logging on to the website in order to file and pay your sales tax return in Massachusetts. Massachusetts imposes taxes on income sales and use meals and room occupancy corporate income and non-income measures other business income estates and cigarettes alcohol and marijuana among other things. With the local option the meals tax rises to 7 percent.

Find your Massachusetts combined state and local tax rate. These small amounts add up to a sizable revenue source. Sales of meals to Harvard faculty and staff are taxable.

In MA transactions subject to sales tax are assessed at a rate of 625. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Contact Us Your one-stop connection to DOR.

You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Be sure to check if your location is subject to the local tax.

How will I make my advance payment on MassTaxConnect. Massachusetts Department of Revenue. The meals tax rate is 625.

Sales of meals to Harvard students are tax-exempt if. MassTaxConnect Log in to file and pay taxes. The Massachusetts Sales Tax is administered by the Massachusetts Department of Revenue.

Locate the account type and selectthe Returns hyperlink. What are the tax rates for sales and meals tax. The state meals tax is 625 percent.

Follow this link httpsmtcdorstatemausmtc to. The base state sales tax rate in Massachusetts is 625. Meals are also assessed at 625 but watch out.

To make a bill payment. Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax. Phone numbers for the Sales Tax division of the Department of Revenue are as follows.

The maximum tax that can be enacted on meals in Massachusetts compares favorably to that in other New England states. A Massachusetts Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Meals are sold by Harvard-operated dining facilities and.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Massachusetts Meals Tax Restaurant Tax. Sparkling wine 070gallon. Select the Period you want.

Eligible businesses will be able to delay without penalty sales meals and room occupancy taxes for March April and May until June 20. Log in to MassTaxConnect. Thus a 40 restaurant tab generates 280 in meals tax of which 30-cents goes to a city or town that has enacted the local option.

Select Return Payment in the payment type dropdown. Meals Tax Payment - Harvard as Purchaser. Businesses that paid less than 150000 in 2019 sales and meals or room occupancy taxes are eligible.

If you are a third party designee you will first need to select the individual or business from the Individuals and Businesses tab. To learn more see a full list of taxable and tax-exempt items in Massachusetts. MTF also looks at jurisdictional compliance and administrative issues that impact a taxpayers liability.

How to Sign-in and File a Return on Massachusettss Website. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

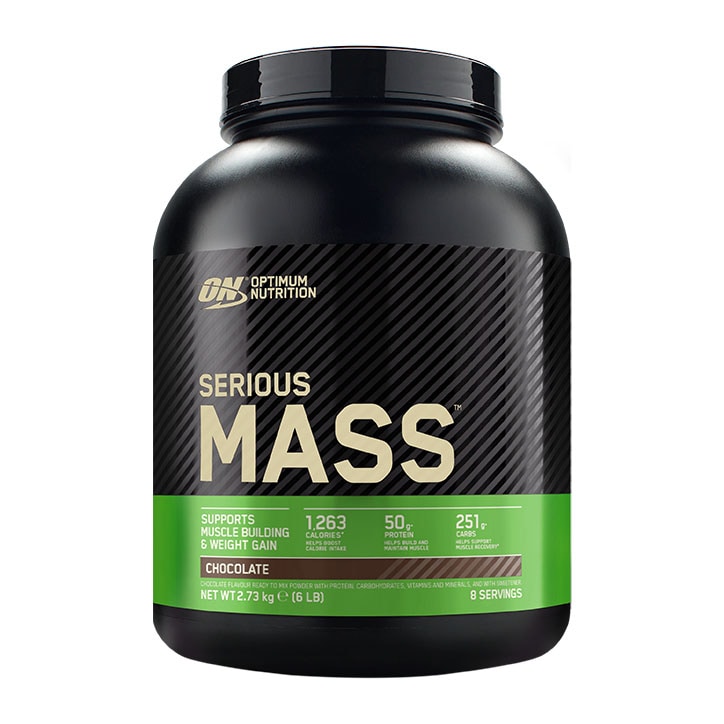

Optimum Nutrition Serious Mass Chocolate 2700g Powder Holland Barrett

12 Miraculous Health Benefits Of Eating Organic Almonds Health Benefits Of Almonds Almond Benefits Almond Butter Benefits

Optimum Nutrition Serious Mass Chocolate 2700g Powder Holland Barrett

Radical New Method Can Directly Edit Human Cells To Get Rid Of Genetic Disease Cloud Services What Is Cloud Computing Cloud Computing Services

Craigslist Cars For Sale Used Cheap Used Cars Cheap Cars For Sale

Protein Works Total Mass Matrix Mass Gainer Calorie Dense Weight Gainer Protein Powder Chocolate Silk 2 Kg Amazon Co Uk Health Personal Care

Barnacle Billy S At Perkins Cove Ogunquit Maine Vintage 1969 Postcard Ogunquit Cove Ogunquit Maine

Twohabits On Instagram Climate Animals By Danieldesignwork And Daphloong The Authors Wanted To Channel A Heavy Subje Extinction Climates Concept Design

C D L Vehicle Groups And Endorsements Trucking Life Cdl Trucks

Christina S Cafe Breakfast Brunch A Food Cafe

Pin On Atlanta Foodie Bucket List

Shepherd S Night A Christmas Tradition Bethlehem Christmas Christmas Traditions Christmas Food